- AgTech Digest

- Posts

- Collaborative Momentum

Collaborative Momentum

Inside the partnerships shaping AgTech’s next wave of growth and innovation in 2025

Good morning growers,

Partnerships continue to define how the AgTech ecosystem grows and scales in 2025. As technologies mature, companies are shifting from isolated pilot projects to collaborative models that merge research, data, and commercialization. The iGrow Dashboard highlights how firms are linking tools, platforms, and expertise to address global challenges—from carbon measurement and regenerative practices to AI-powered plant breeding and fully automated production systems.

And, a warm welcome to our new iGrow Network members. We’re glad to have you on board and look forward to keeping you updated on the latest innovations, opportunities, and trends in AgTech. Not a member yet? Register now to join the network.

Estimated Reading Time: 6 - 7 minutes

OUR LATEST AGTECH INTELLIGENCE DASHBOARD SNAPSHOT

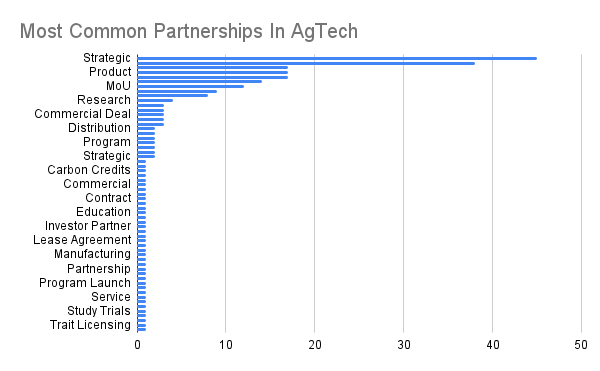

How Do AgTech Companies Partner?

Across sectors, “product/technology integration” and “strategic” tie-ups dominate. Plant Science and Crop Genomics feature heavily in cross-company R&D—e.g., AI-assisted trait development, gene editing toolchains, and distribution agreements to push nitrogen-fixing microbes or biologicals to market. Controlled-environment production (greenhouse + vertical farming) shows steady movement toward interoperable systems: climate computers integrating root-zone and gutter data, AI harvest forecasting, and education/research consortia to expand the talent pipeline. Precision Agriculture remains the connective tissue—robotics, satellite/drone imagery, and farm management platforms—often coupled with finance or MRV to unlock incentives. Carbon Market activity is increasingly programmatic (soil/forest removals with long-dated delivery), while AgriFinTech partnerships focus on working-capital access (forward-flow agreements) and farm accounting integrations.

Regionally, North America leads on volume and breadth—robotics fleet expansions, long-term carbon credit offtakes, farm-finance scale-ups, and retailer/distribution channels for inputs and biologicals. Europe concentrates on greenhouse automation and low-energy production research, plus strong Plant Science collaborations anchored by Netherlands/Switzerland hubs. The Middle East continues to scale CEA infrastructure (UAE centers of excellence, giga-scale vertical farms), alongside digital farm management rollouts across MENA-linked acreage; Israel-origin tech appears frequently in carbon and data/quantum projects. Asia presents mixed momentum: Southeast Asia sees vertical farming deployments and blockchain/traceability pilots, China advances ag-RWA/payments and drone MoUs, and Japan collaborates on climate-risk analytics for Africa. Latin America highlights crop breeding (rice, wheat), fertilizer/offtake MoUs, and supply-chain data partnerships; Oceania focuses on livestock (virtual fencing/public-lands pilots) and emissions-reduction research initiatives.

Deal structures skew toward integrations (product, technology, and platform), with research partnerships and MoUs as on-ramps to commercialization; joint ventures appear where asset intensity is high (indoor farms, funds, facilities). Notable themes cut across sectors: (1) data interoperability from field sensor → satellite → AI model → retailer/bank workflow; (2) measurement and verification (regen, carbon, Scope 3) embedded into input distribution and grower services; and (3) regionalization—solutions localized via local banks, co-ops, universities, and public agencies to accelerate adoption. Overall, partnerships are being used less as one-off pilots and more as scale mechanisms linking agronomy, data, finance, and distribution.

Want to see which emerging objectives are beginning to reshape the landscape—and how they compare?

Book a discovery call to explore our solutions directly: Schedule here.

🎧 Prefer listening over reading?

Catch the full recap on this week’s AgTech Digest Podcast—available now on Spotify, Apple Podcasts, or your favorite platform.

PLANT SCIENCE

New Partnerships, Funding & Product For Plant Science

Syngenta Crop Protection and Taranis have announced a new strategic partnership to scale their proven digital crop management model across the Midwest. Building on successful 2025 pilot results, the companies will jointly equip agricultural retailers with advanced AI technology and agronomic expertise to deliver faster, more data-driven decisions for growers.

Profluent Bio announced a strategic collaboration with Corteva. The partnership combines artificial intelligence and gene editing to create a new generation of sustainable and resilient crops. The companies will design targeted, AI-driven gene-editing solutions within Corteva’s Genlytix™ ecosystem, a suite of technologies supporting next-generation plant breeding and genome precision.

The James Hutton Institute has secured a £3 million investment from Scottish Enterprise to establish a new high throughput phenotyping facility within its Advanced Plant Growth Centre (APGC), part of the Crop Innovation Centre (CIC). The technology-driven facility will enable researchers to study plant architecture and health using lasers and sensors, mapping how genetics and environmental changes affect crop performance.

Indigo Ag has launched Nemora FP™, a microbial bionematicide seed treatment specifically designed for soybeans. Recently registered with the U.S. Environmental Protection Agency (EPA), the product will be available for use in spring planting. According to company data, Nemora FP™ reduces nematode egg hatch by an average of 68% while maintaining the crop’s yield potential.

CEA

CEA Updates: New Partnership, New Initiatives & More!

Grønt fra Nord, has announced the successful completion of a USD 1.2 million convertible financing round. The investment marks a significant milestone in the company’s growth strategy and reinforces support from both existing and new partners.

Agroz Inc. has announced a strategic collaboration with U.S.-based Harvest Today, LLC. The partnership will introduce the Agroz Groz Wall, a modular vertical growing solution designed to make pesticide-free, nutrient-rich produce accessible closer to where it is consumed.

Viemose DGS and Ledgnd have announced a partnership to merge their respective technologies for high-tech leafy greens production. The integration connects Ledgnd’s MyLedgnd data platform directly with Viemose’s Moving Gutter Systems, creating a unified digital dashboard that compiles real-time insights from sensors, plant feedback, climate computers, and other measurement systems.

Premier Tech Growers and Consumers has expanded its trusted PRO-MIX® AGTIV® product lineup to better serve Controlled Environment Agriculture (CEA) growers. The enhanced portfolio improves crop productivity and quality while reaffirming Premier Tech’s commitment to excellence in CEA, according to the company.

UK-based agri-tech company LettUs Grow announced a new strategic partnership with HAWE Cultivation Systems BV. The collaboration marks HAWE’s addition to LettUs Grow’s Global Partnership Programme as an integration partner, reflecting both companies’ shared commitment to advancing sustainable cultivation technologies.

OTHER NEWS

Other Updates: New Funding Round, New Initiative & More!

Klim launched its new digital companion tool in the UK. The platform is designed to support farmers in adopting regenerative practices while helping F&B companies measure progress and impact across global supply chains.

Planet Labs PBC and VITO announced an extension of their partnership to advance global Earth observation solutions. The collaboration combines Planet Labs’ satellite imaging capabilities with VITO’s analytics platforms to provide near real-time insights supporting agriculture, environmental monitoring, and climate resilience.

UbiQD, a leader in quantum dot (QD) materials, announced the publication of peer-reviewed results from a landmark greenhouse study funded by the USDA through its NIFA. Conducted at the University of California, Davis, the study shows that UbiQD’s luminescent QD-laminated glass significantly enhances plant growth, nutrient uptake, and energy efficiency in CEA systems—without electricity or mechanical input.

Gowan Company and Ceradis have announced the integration of Ceradis into the Gowan Group, combining the company's international strength in crop protection and seeds with Ceradis’ expertise in formulation, development, and registration of crop protection compounds. The partnership aims to accelerate the delivery of innovative, sustainable solutions to growers worldwide.

UPCOMING EVENTS

Special Thanks to Our Directory Members

Established Plan:

SpectraGrow, LettUs Grow, Harvest Returns, Women in CEA, Harnois Greenhouses, Verde Compacto

Scale-Up Plan:

Sollum Technologies, Babylon Micro-Farms, Ounce of Hope Aquaponics, Grow-Tec, Microclimates, Growtainer

Not listed yet? Add your company to the directory and start getting noticed!

Reply